Paying with Bitcoin Made Simple (Even Grandma Can Do It)

Why Bitcoin Payment Methods Are Easier Than You Think

Bitcoin payment methods have come a long way from the early days of copying and pasting long wallet addresses. Today's Bitcoin payments work just like sending an email—simple, fast, and available 24/7 without banks or holidays getting in the way.

The main Bitcoin payment methods are:

• Wallet-to-wallet transfers - Direct peer-to-peer payments using QR codes or addresses

• Payment processors - Third-party services that handle crypto-to-fiat conversion

• Lightning Network - Instant, low-cost payments for small amounts

• NFC tap payments - Contactless Bitcoin payments using your phone

• Layer 2 solutions - Secondary networks for faster, cheaper transactions

Bitcoin operates as a peer-to-peer electronic cash system that lets you send money anywhere in the world without asking permission from a bank. The network runs 24/7, even on weekends and holidays, and there's no fee to receive payments. As one Bitcoin advocate puts it: "Bitcoin is the easiest way to transact at a very low cost."

Whether you're buying coffee with a QR code scan or sending money across borders, Bitcoin payments have become surprisingly user-friendly. The key is understanding which method works best for your situation.

I'm Justin McKelvey, and through my work at SuperDupr helping businesses integrate digital payment solutions, I've guided countless entrepreneurs through implementing Bitcoin payment methods that actually work for real customers. My experience has shown me that the biggest barrier isn't technical complexity—it's simply knowing which approach fits your needs.

Bitcoin payment methods: The 4 Ways to Send and Spend BTC

Think of Bitcoin payment methods like choosing how to pay at your favorite restaurant. You could use cash, a credit card, or even tap your phone—each works, but they feel different and have their own perks. Bitcoin works the same way, with four main approaches that each shine in different situations.

Wallet-to-wallet transfers are the most straightforward approach. You're sending Bitcoin directly from your wallet to someone else's, just like handing over cash. No middleman, no extra fees beyond the network cost, and the transaction gets recorded permanently on the blockchain. It's pure peer-to-peer money in action.

QR code scanning makes wallet-to-wallet payments incredibly simple. Instead of typing out a long Bitcoin address (and praying you didn't make a typo), you just point your phone's camera at a QR code. The wallet app fills in all the details, you enter the amount, and hit send. It's as easy as scanning a restaurant menu.

NFC tap payments bring Bitcoin into the contactless world we're all used to. Just like tapping your phone to pay for groceries, some Bitcoin wallets now let you tap your device against a payment terminal. The magic happens instantly—no scanning, no typing, just tap and go.

Payment processors handle all the technical complexity behind the scenes. These services convert your Bitcoin to regular dollars at checkout. You get to spend your Bitcoin, while the merchant receives the cash they're comfortable with. Everyone wins.

Choosing the right Bitcoin payment methods

When I help clients at SuperDupr pick their Bitcoin payment methods, we always start with four key questions that make the choice crystal clear.

Security matters most when you're moving real money around. Direct wallet payments give you maximum control since you hold your own private keys—nobody else can touch your Bitcoin. Payment processors are convenient, but you're temporarily trusting someone else with your funds while they handle the conversion.

Speed varies dramatically depending on your approach. Lightning Network payments happen instantly, perfect for buying coffee or splitting a dinner bill. Regular on-chain Bitcoin payments take anywhere from 10 minutes to an hour, depending on how busy the network is and how much you're willing to pay in fees.

Cost can make or break your payment experience. Lightning payments cost less than a penny, while on-chain Bitcoin fees swing from a dollar to fifty dollars when the network gets congested. Payment processors typically charge 1-3% of your transaction, similar to credit cards.

Ease of use determines whether you'll actually enjoy using Bitcoin for payments. QR code scanning works for almost everyone—it's intuitive and hard to mess up. Managing your own wallet requires a bit more tech comfort, but gives you complete independence from third parties.

Comparing Bitcoin payment methods

The biggest choice you'll make is between on-chain and Lightning Network payments. On-chain transactions settle directly on Bitcoin's main blockchain—they're rock-solid secure but slower and pricier. Lightning Network operates on a second layer, offering instant payments with tiny fees. Think of Lightning as perfect for daily spending, while on-chain works better for larger, more important transfers.

Direct payments versus processors comes down to control versus convenience. Direct payments keep you in the driver's seat with complete privacy and no intermediaries taking cuts. Processors handle all the technical stuff and currency conversion, but you're paying for that service and trusting them with your Bitcoin temporarily.

Mobile versus desktop wallets each have their strengths. Mobile wallets excel at real-world payments with their cameras for QR codes and NFC capabilities. Desktop wallets offer advanced features like multi-signature security and better privacy controls, making them ideal for larger amounts or more complex transactions.

Payment Method Speed Fees Security Ease of Use Bitcoin On-chain 10-60 min $1-50 Highest Moderate Lightning Network Instant <$0.01 High Easy Payment Processor Instant 1-3% Moderate Easiest Traditional Card 2-3 days 2-4% Moderate Easy

The beauty of Bitcoin is that you're not locked into one approach. Many people use Lightning for small purchases, on-chain for larger transfers, and payment processors when shopping with merchants who prefer traditional currencies. It's about picking the right tool for each job.

How to Pay with Bitcoin Step-by-Step

Making your first Bitcoin payment feels intimidating until you actually do it. Then you realize it's like sending an email—once you know the steps, it becomes second nature. I've walked countless clients through their first Bitcoin payment methods, and the reaction is always the same: "That's it? That was easier than I thought!"

Start by buying some Bitcoin from a regulated exchange using your bank account or debit card. Think of this like loading money onto a gift card—you're converting your dollars into Bitcoin that you can spend later. Most exchanges guide you through the process step by step, and you'll have Bitcoin in your account within minutes.

Next, set up your wallet—this is where you'll actually store and spend your Bitcoin. Download a mobile wallet app for everyday payments or consider a hardware wallet if you're planning to hold larger amounts. Your wallet automatically generates a unique address for receiving Bitcoin and keeps your private keys secure.

Transfer your Bitcoin from the exchange to your personal wallet. This step gives you complete control over your funds and prepares you for making actual payments. It's like withdrawing cash from an ATM—the money moves from the bank's control to yours.

When you're ready to pay someone, you'll need their Bitcoin address. The easiest way is scanning their QR code with your phone's camera. No typing long strings of letters and numbers, no worrying about mistakes. The QR code contains all the payment information you need.

Choose your transaction fee before hitting send. Higher fees get your payment confirmed faster (usually within 10-20 minutes), while lower fees save money but might take an hour or two. Most wallets suggest the right fee automatically, so you don't need to stress about this part.

Hit send, and your transaction broadcasts to the Bitcoin network. Miners around the world verify your payment and include it in the next block. You can track the progress in real-time—most wallets show you exactly how many confirmations your transaction has received.

Setting up a wallet grandma will love

Mobile wallets work best for beginners because they handle all the technical complexity behind the scenes. Look for wallets with clean interfaces, helpful customer support, and solid security reputations. The best ones feel just like using any other app on your phone.

Hardware wallets become essential once you're holding serious amounts of Bitcoin. These small devices store your private keys completely offline, protecting against hackers while still letting you make payments when needed. Think of them like a safe that connects to your computer only when you want to spend money.

Every wallet generates a special recovery phrase—usually 12 to 24 words that can restore your Bitcoin if your phone breaks or gets stolen. Write these words down on paper and store them somewhere safe. This phrase is literally the master key to your funds, so treat it like you would cash or important documents.

Hitting "Send": final checklist

Before sending any Bitcoin payment, take thirty seconds to double-check everything. Verify the recipient's address is correct—Bitcoin transactions can't be reversed once they're sent. Confirm the amount you're sending matches what you agreed to pay. Choose appropriate fees based on how quickly you need the payment to arrive.

Keep records of your transaction ID for accounting and tax purposes. Your wallet automatically saves this information, but having your own records makes life easier come tax season.

The whole process typically takes just a few minutes from start to finish. After your first successful Bitcoin payment, you'll wonder why anyone makes such a big deal about Bitcoin payment methods—they're honestly simpler than most traditional payment systems once you get the hang of it.

More info about Crypto Payment Integration

Fees, Speed & Safety: Optimizing Your Bitcoin Checkout

Let's be honest—nobody wants to pay $30 in fees to buy a $5 coffee. Understanding how Bitcoin fees work is the key to choosing the right Bitcoin payment methods for each situation.

Bitcoin fees work differently than credit cards. Instead of charging a percentage of your purchase, Bitcoin charges based on how much space your transaction takes up in a block. This means sending $10 or $10,000 costs exactly the same—it's the network congestion that determines your fee, not your purchase amount.

Miner fees fluctuate based on demand. Think of it like surge pricing for rideshares. When lots of people want to make Bitcoin transactions at the same time, fees go up. During quiet periods (often weekends), you might pay under $1. During busy times, fees can spike to $20-50 per transaction.

The mempool is your friend for timing payments. The mempool is essentially a waiting room for unconfirmed transactions. When it's crowded, fees are high. When it's empty, fees drop dramatically. Smart Bitcoin users check mempool status before making payments to choose the best time and fee level.

Many modern wallets support replace-by-fee (RBF), which lets you bump up the fee on a pending transaction if you need it confirmed faster. It's like paying extra to jump ahead in line—handy when you're standing at a checkout counter waiting for confirmation.

Bitcoin's proof-of-work security is what makes these payments so trustworthy. Miners around the world compete to solve mathematical puzzles, and tampering with transactions would require controlling at least 51% of this massive global network. That's why Bitcoin transactions are considered extremely secure once confirmed.

Layer 2 to the rescue

Here's where Bitcoin payment methods get really exciting. Layer 2 solutions solve the fee and speed problems while keeping Bitcoin's rock-solid security.

The Lightning Network has been a game-changer for everyday Bitcoin payments. Lightning enables instant Bitcoin payments with fees under a penny. It's perfect for buying coffee, tipping content creators, or any small purchase where waiting 30 minutes for confirmation doesn't make sense.

What's really impressive is that over 1 million wallets have already been created using Lightning-compatible payment apps. The network effect is building, and more merchants accept Lightning payments every month.

Layer 2 networks like Arbitrum, Optimism, and Base have expanded beyond just Ethereum to support Bitcoin-backed tokens and stablecoins. Many payment processors now integrate these networks to offer faster, cheaper transactions while maintaining the security benefits of blockchain technology.

Micro-payments are finally viable thanks to Layer 2 solutions. You can send fractions of a dollar instantly and cheaply—something that's impossible with traditional payment systems that have minimum fees. This opens up entirely new business models for content creators and service providers.

Staying safe & compliant

Cold storage is your insurance policy for larger Bitcoin amounts. Keep significant funds in hardware wallets or paper wallets stored offline. Only keep spending amounts in "hot" mobile wallets connected to the internet. Think of it like keeping most of your money in a bank vault while carrying just spending cash in your wallet.

Multi-signature wallets add an extra security layer for advanced users. These require multiple private keys to authorize transactions—like requiring multiple people to sign a check. It's overkill for small amounts but valuable for business payments or large personal holdings.

KYC rules and transaction reporting are part of the regulated landscape now. Most legitimate exchanges require identity verification, and you'll need to keep records of Bitcoin purchases and sales for tax purposes. In the US, spending Bitcoin can trigger tax consequences since it's treated as property, not currency.

The good news is that staying compliant doesn't have to be complicated. Keep good records, work with regulated exchanges, and consult a tax professional if you're making significant Bitcoin transactions.

Scientific research on Proof of Work

Accepting Bitcoin Payments as a Merchant

Running a business and thinking about Bitcoin payment methods? You're not alone. Through our work at SuperDupr, we've seen how accepting Bitcoin can transform a business—opening doors to global customers while cutting down on those pesky payment processing fees that eat into your profits.

The beauty of Bitcoin payments for merchants is their simplicity. Point-of-sale apps turn any smartphone or tablet into a Bitcoin payment terminal. Your customer scans a QR code displayed on your screen, sends the payment, and you get confirmation almost instantly with Lightning Network payments or within minutes for regular Bitcoin transactions. No card readers, no monthly terminal fees, no "sorry, our system is down" moments.

For businesses wanting complete control, open-source payment gateways like BTCPay Server are game-changers. You accept Bitcoin payments with zero processing fees and no middleman taking a cut. Your funds go directly to your wallet, and you keep all your customer data private. It's like having your own bank, but better.

Invoice generation becomes surprisingly neat with Bitcoin. You can create professional invoices that include QR codes, exact payment amounts, and expiration times. Many of these systems integrate seamlessly with popular accounting software, so your bookkeeping stays organized without extra work.

One feature we love helping clients set up is flexible settlement options. You can choose to receive payments entirely in Bitcoin, convert everything to dollars automatically, or split the difference. Want 70% in cash and 30% in Bitcoin? No problem. It's your business, your choice.

Fast-track integration for websites

Getting Bitcoin payment methods working on your website doesn't require a computer science degree. Most e-commerce platforms now offer API plugins and extensions that add Bitcoin checkout options with just a few clicks. Whether you're running WooCommerce, Shopify, or another platform, there's likely a plugin waiting for you.

BTCPay Server integration deserves special mention for businesses wanting more control. This free, open-source solution provides powerful APIs for custom integrations. You can tailor the payment experience exactly to your brand while maintaining complete control over the process. No third-party fees, no data sharing, no surprises.

Before going live, always test thoroughly. Process small test transactions, verify that confirmations work correctly, and make sure your accounting systems properly track Bitcoin payments. We've learned that a few minutes of testing saves hours of headaches later.

More info about Accept Cryptocurrency Payments

More info about how to Integrate Crypto Payments

Growing your customer base with Bitcoin

Accepting Bitcoin payments opens your business to global shoppers in ways traditional payment methods simply can't match. Bitcoin works identically whether your customer is next door or on the other side of the world. No currency conversion fees, no international payment restrictions, no "sorry, we don't accept cards from that country" messages.

Lower chargeback risk is a massive benefit that many merchants find only after implementing Bitcoin payments. Since Bitcoin transactions are irreversible once confirmed, you eliminate the chargeback fraud that costs merchants billions annually. When a Bitcoin payment confirms, it's final—no angry phone calls from payment processors months later.

There's also real marketing value in accepting Bitcoin. It signals that your business is innovative and forward-thinking, attracting tech-savvy customers who often become your most loyal supporters. Many of our clients report that Bitcoin users tend to have higher average order values and become repeat customers more frequently than traditional payment users.

The bottom line? Bitcoin payment methods aren't just about technology—they're about giving your customers more ways to pay while potentially saving your business money and expanding your reach.

Frequently Asked Questions about Bitcoin payment methods

Let's tackle the three questions we hear most often when helping businesses implement Bitcoin payment methods. These are the practical concerns that come up in nearly every conversation.

Are Bitcoin payments reversible?

Here's something that surprises many people: Bitcoin payments are completely irreversible once they're confirmed on the blockchain. Think of it like handing someone cash—once it leaves your hand, it's gone.

This isn't a bug, it's a feature. Bitcoin was designed this way to eliminate the fraud and chargeback headaches that cost merchants billions every year. No more customers buying something, receiving it, then calling their bank to reverse the payment.

But this also means you need to be extra careful. Double-check that wallet address before hitting send. If you accidentally send Bitcoin to the wrong address, there's no customer service hotline to call. The transaction is permanent.

Some merchants will voluntarily send you a refund by making a separate Bitcoin payment back to you. But that's their choice, not an automatic system like credit card chargebacks.

Who pays the miner fee—the buyer or the seller?

The person sending the Bitcoin always pays the miner fee. So if you're buying something with Bitcoin, you'll pay the network fee on top of the purchase price.

It's like paying postage when you mail a package—the sender covers the delivery cost. There's no fee to receive Bitcoin payments, which is great news for merchants.

Many businesses handle this in different ways. Some build the fee into their pricing. Others eat the cost as a customer service perk. Payment processors often absorb miner fees and charge merchants a percentage instead, similar to how credit card companies work.

The good news? Lightning Network payments cost fractions of a penny, making fees almost irrelevant for small purchases.

What are the tax implications of spending BTC?

This one catches people off guard: spending Bitcoin is usually considered "selling" it for tax purposes. That morning coffee you bought with Bitcoin? The tax authorities see it as selling Bitcoin for dollars, then buying coffee with those dollars.

If your Bitcoin went up in value since you bought it, you might owe capital gains tax on the profit. If it went down, you could potentially claim a capital loss. The rules vary by country, but most treat Bitcoin like an investment asset, not currency.

Keep detailed records of everything—when you bought Bitcoin, what you paid, when you spent it, and what it was worth at that moment. Many exchanges now provide tax forms to help with reporting, and there are specialized crypto tax software tools that can track everything automatically.

We always recommend consulting with a tax professional who understands cryptocurrency. The rules are still evolving, and getting proper advice upfront can save you headaches later.

Conclusion

The journey through Bitcoin payment methods reveals a payment system that's surprisingly accessible once you understand the basics. What started as copying and pasting long wallet addresses has transformed into QR code scanning, NFC tapping, and instant Lightning Network payments that work just like the digital payments you already know.

The real magic happens when you realize Bitcoin operates completely outside traditional banking hours. While your bank sleeps on weekends, Bitcoin keeps working. While international wire transfers take days and cost $30-50, Bitcoin moves across borders in minutes for a few dollars.

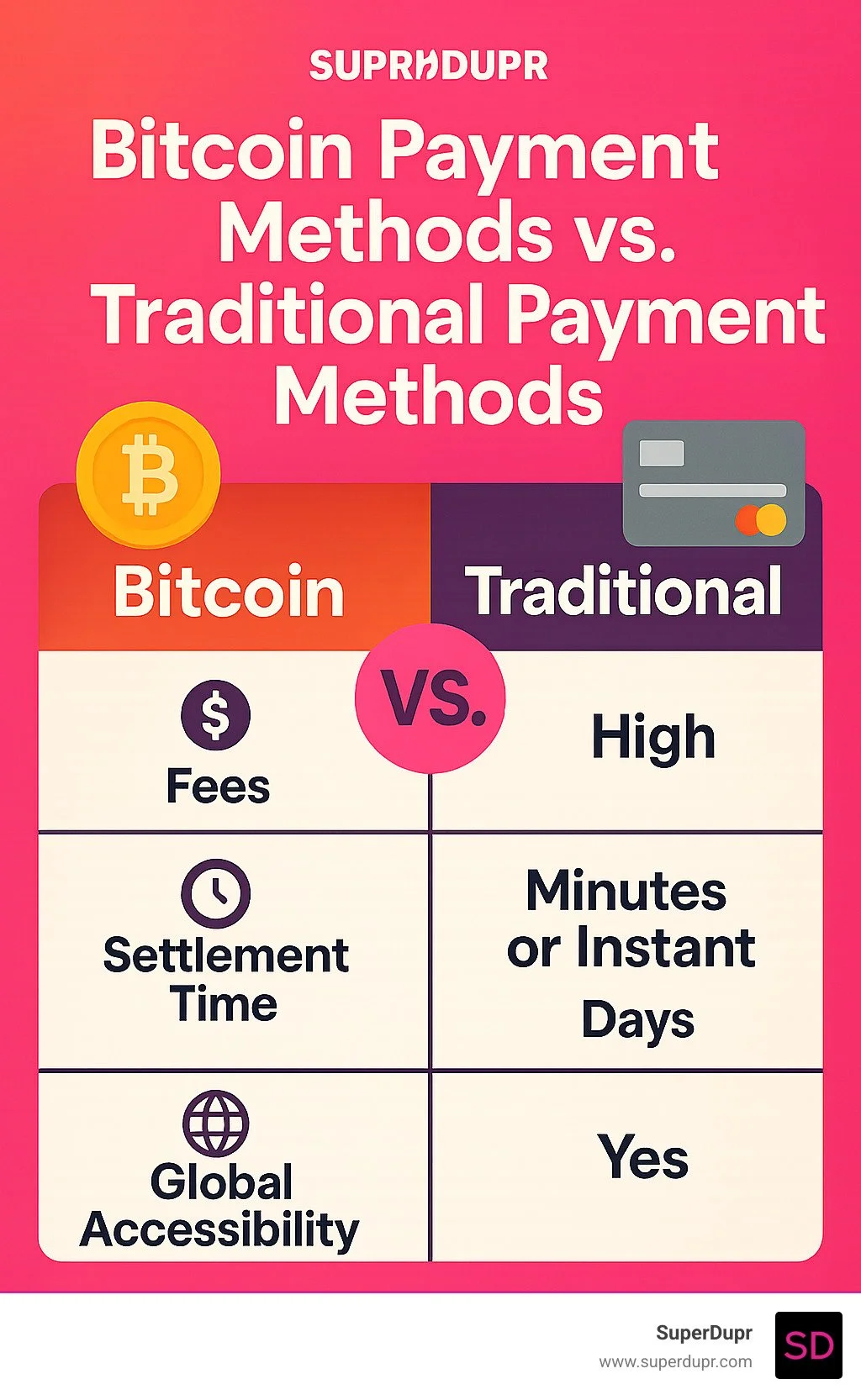

The practical advantages are clear: no chargebacks for merchants, global accessibility without currency conversion headaches, and the ability to send money anywhere without asking permission from financial institutions. Layer 2 solutions like Lightning Network have solved the speed and cost issues that once made Bitcoin impractical for small purchases.

From our experience at SuperDupr helping businesses integrate these systems, the biggest hurdle isn't technical complexity—it's simply knowing which approach fits your needs. A coffee shop benefits from Lightning Network's instant payments, while a luxury goods merchant might prefer the security of on-chain confirmations.

The infrastructure exists today for both spending and accepting Bitcoin practically. Whether you're using a mobile wallet to pay for lunch or implementing BTCPay Server to accept global payments, the tools have matured beyond the early adopter phase.

Looking ahead, we're seeing even simpler interfaces, better mobile experiences, and broader merchant adoption. The combination of Bitcoin's proven security with Layer 2 innovation creates a payment system that's both and practical.

At SuperDupr, we help businesses steer these cryptocurrency integrations with the same focus on practical results that drives all our strategy and development work. Bitcoin payment methods aren't just about technology—they're about opening new markets, reducing costs, and serving customers in ways traditional payments can't match.

The future is already here for those ready to accept it. Bitcoin payments work today, and they're only getting better.