Accept Cryptocurrency Payments Without Losing Your Mind (or Wallet)

Why Businesses Are Embracing Cryptocurrency Payments

Accept cryptocurrency payments to tap into a growing market of over 550 million crypto users worldwide while enjoying lower transaction fees and eliminating chargebacks. Here's what you need to know:

Quick Setup Options: Payment processors, direct wallet integration, or e-commerce plugins

Transaction Fees: Typically under 1% compared to credit card fees of 2-4%

Settlement Options: Convert to USD/EUR immediately or hold cryptocurrency

Popular Coins: Bitcoin, Ethereum, USDC, USDT, and other major cryptocurrencies

Implementation Time: 1-7 days depending on solution chosen

The digital payments landscape is evolving rapidly, and cryptocurrency represents the next frontier for forward-thinking businesses. By accepting Bitcoin, Ethereum, and other digital currencies, merchants can reach customers in over 176 countries while reducing processing fees and eliminating fraud-related chargebacks.

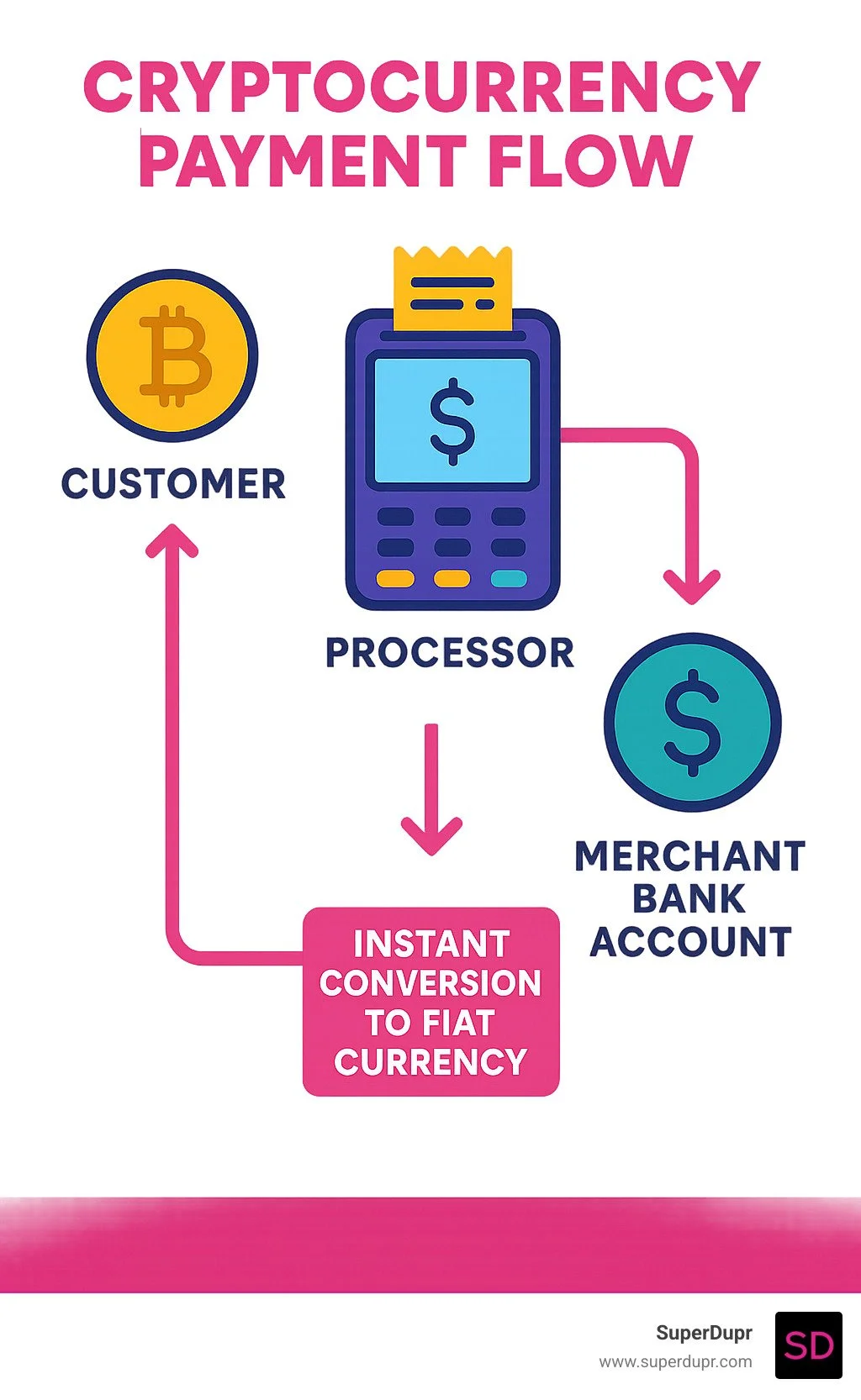

Accepting cryptocurrency doesn't mean you need to become a crypto expert. Modern payment processors handle the complexity, allowing you to receive traditional currency in your bank account while your customers pay with their preferred digital asset.

"We've increased our conversion rates and attracted more customers who value privacy and prefer crypto payments," reports one online retailer who implemented a crypto payment gateway.

I'm Justin McKelvey, founder of SuperDupr, where I've helped dozens of businesses implement cryptocurrency payment solutions that balance innovation with practical business needs, allowing them to accept cryptocurrency payments without the technical headaches or compliance concerns.

Accept Cryptocurrency Payments 101: Why, How & Key Trade-Offs

Cryptocurrency isn't just making headlines anymore—it's making cash registers ring. With the global crypto market now exceeding $1 trillion, we're seeing real people eager to spend their digital assets on everyday purchases. For business owners like you, this represents an exciting frontier with some important learning curves.

Think of blockchain—the technology powering cryptocurrency payments—as a digital ledger that everyone can see but nobody can tamper with. Unlike traditional payment systems where your customer's credit card data bounces between multiple vulnerable points, crypto transactions are verified by a network of computers without needing middlemen. This fundamental difference creates a more secure payment environment.

The numbers tell a compelling story. According to a 2022 report, credit card fraud remains the most common form of identity theft, affecting millions of consumers annually. When you accept cryptocurrency payments, your customers never share sensitive financial information—dramatically reducing fraud risk for everyone involved.

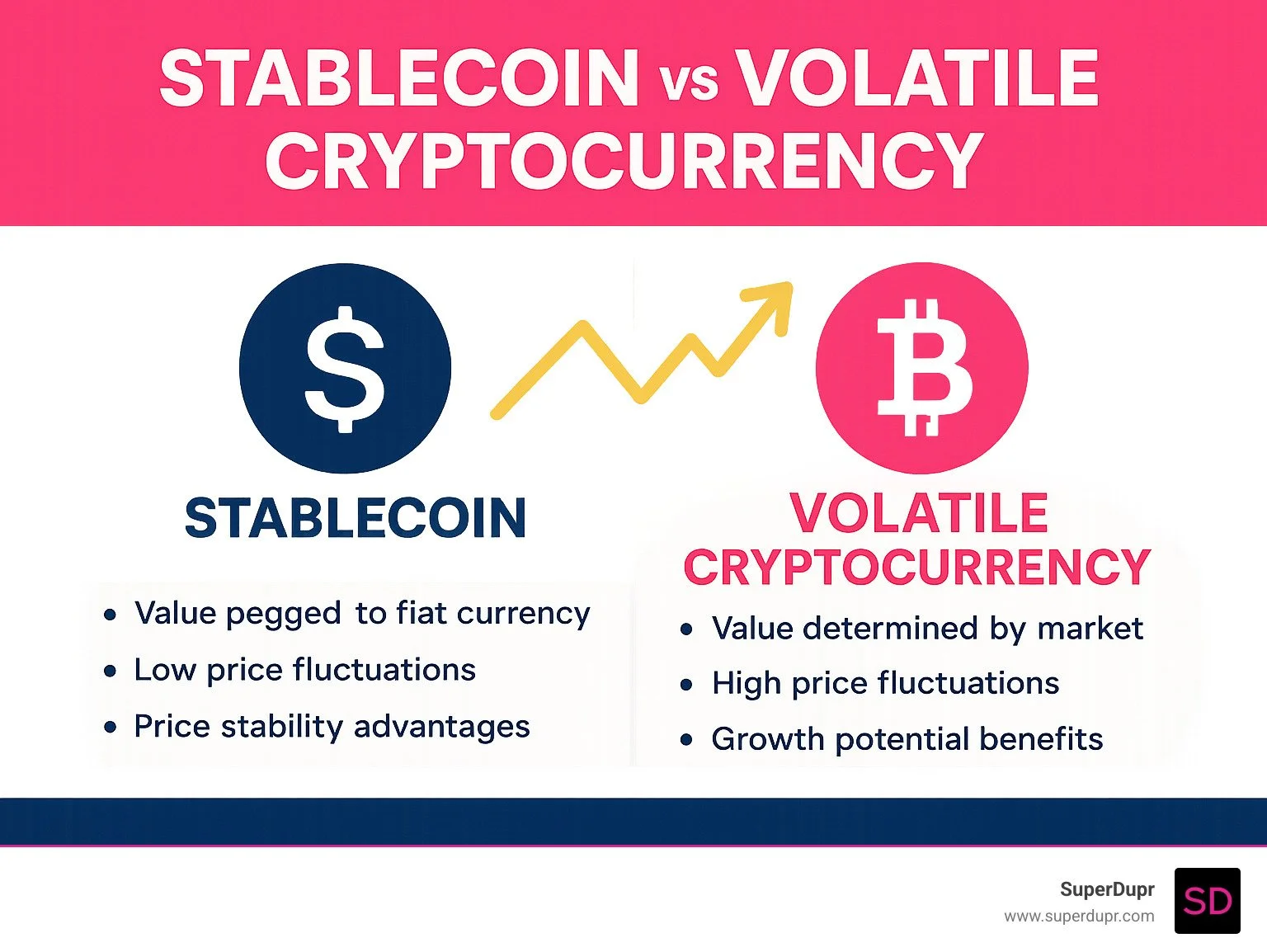

Let's be real about the trade-offs, though. Cryptocurrency prices can swing wildly—Bitcoin might jump or drop several percentage points between your morning coffee and lunch break. While there are ways to manage this volatility (more on that soon), it's something to understand before diving in.

Then there's the tax situation. The IRS views cryptocurrency as property, not currency. This means when a customer pays you in Bitcoin, you'll need to record its dollar value at that moment and report it as income. Yes, this creates some extra accounting homework, but with the right systems, it's manageable.

El Salvador's bold move to adopt Bitcoin as legal tender in 2021 offers some valuable lessons. Despite government backing, they've reportedly lost around $60 million on Bitcoin holdings due to market swings. Their experience reminds us that thoughtful implementation beats rushing in, even for something as promising as crypto payments.

Benefits of Accept Cryptocurrency Payments

When you accept cryptocurrency payments, your business gains access to several game-changing advantages that can transform your bottom line and customer reach.

First, you're instantly global. Cryptocurrency flows across borders without the headaches of international banking or currency conversion. Whether you're selling digital products or physical goods, customers from 176+ countries can pay you without either of you worrying about exchange rates or international transaction fees.

Your profit margins will thank you too. While credit card processors commonly charge between 2-4% per transaction (not counting monthly fees or chargeback penalties), most crypto payment processors keep fees under 1%. For businesses with tight margins, this difference adds up quickly.

Perhaps the most underrated benefit is saying goodbye to chargebacks. Once confirmed on the blockchain, cryptocurrency transactions cannot be reversed—even by the customer. This eliminates the costly, time-consuming chargeback battles that plague online merchants. One e-commerce owner told me, "After implementing crypto payments, we saw a 15% increase in average order value from crypto-paying customers compared to credit card transactions."

You're also tapping into a growing market of over 550 million crypto owners worldwide—typically tech-savvy consumers with above-average spending power. By meeting these customers where they are, you're opening doors to a valuable demographic.

Beyond the practical benefits, accepting cryptocurrency positions your brand as innovative and forward-thinking. In competitive markets, this modern approach can help you stand out from competitors still relying solely on traditional payment methods.

How Crypto Transactions Actually Work

Understanding the basics of how cryptocurrency transactions function helps explain the process, even if you're not technically inclined.

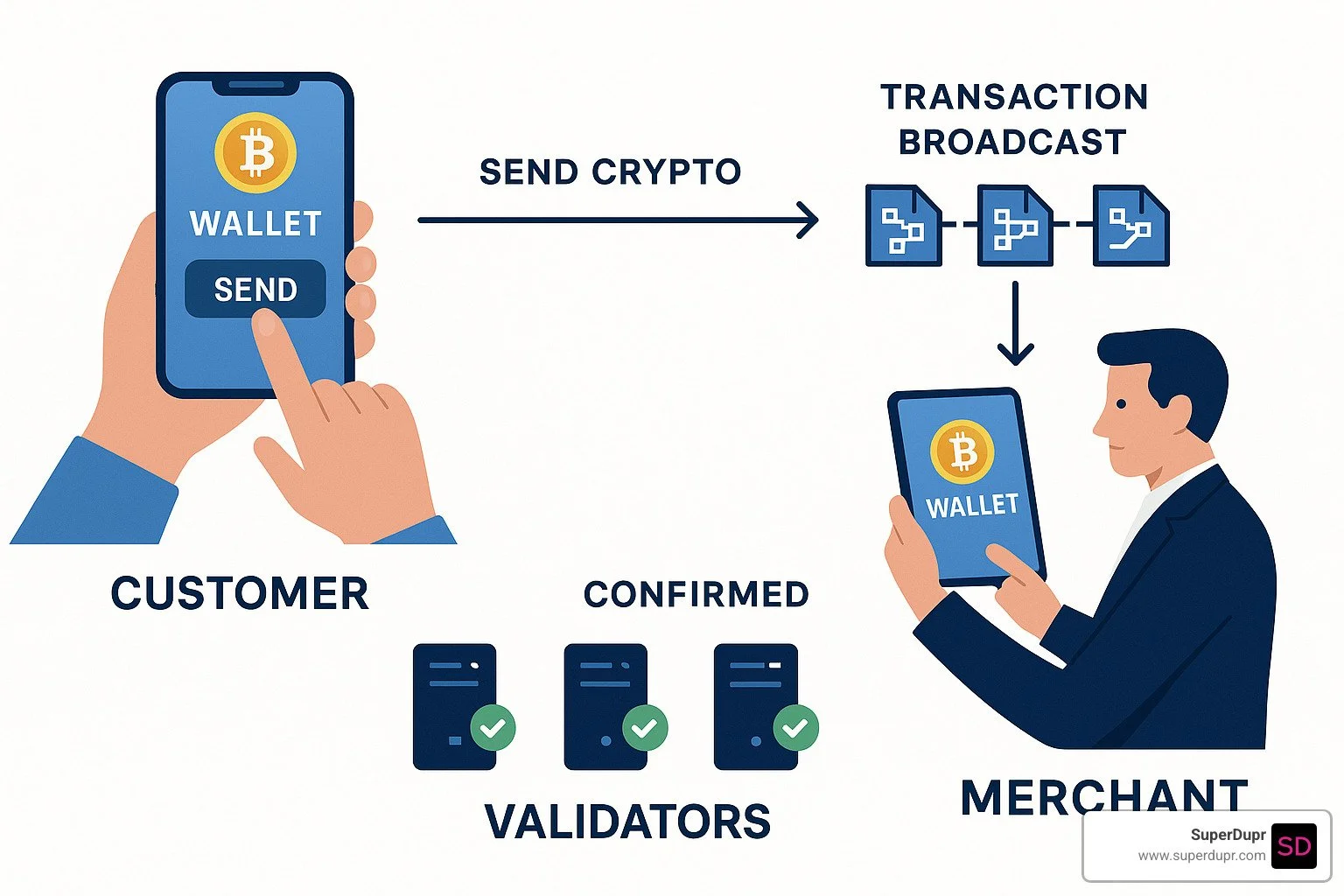

At its heart, cryptocurrency relies on digital wallets—software that stores the cryptographic keys needed to access and transfer funds. Think of a wallet as a combination of your bank account and your PIN, but with much stronger security. These wallets come in many forms: mobile apps, desktop programs, specialized hardware devices, or web-based services.

The magic happens through public-key cryptography. Each wallet has two key components: a public address (which you can share freely, like your email address) and a private key (which must be guarded like the most important password you've ever had). The public address lets people send you cryptocurrency, while the private key authorizes you to send funds to others.

When a customer pays you in cryptocurrency, here's what actually happens behind the scenes: They initiate a transfer from their wallet to your business's public address. This transaction gets broadcast to thousands of computers on the network. These computers (called miners or validators) verify that the customer actually owns the funds they're sending. Once verified, the transaction gets permanently recorded on the blockchain.

The beauty of this system is its finality. Once confirmed (typically within minutes, though timing varies by cryptocurrency), the transaction becomes practically irreversible. This "finality" is what eliminates chargebacks, but it also means you'll need to handle refunds differently—as new, separate transactions rather than reversals.

Risks of Accept Cryptocurrency Payments

Being transparent about the challenges of cryptocurrency acceptance is just as important as highlighting the benefits. Here's what you should consider before taking the plunge:

Price volatility remains the elephant in the room. Bitcoin's value has fluctuated by nearly 8% in a three-month period, and other cryptocurrencies can be even more unpredictable. This volatility can complicate your pricing and cash management unless you implement immediate conversion to traditional currency—a service most payment processors offer.

The irreversibility of transactions is a double-edged sword. While you're protected from chargebacks, you'll need to establish clear refund policies and processes. Since crypto transactions can't be reversed, refunds require creating entirely new transactions and maintaining meticulous records.

Regulatory compliance presents another challenge as governments worldwide continue developing cryptocurrency frameworks. Depending on your location and transaction volume, you may need to implement Anti-Money Laundering (AML) procedures, Know Your Customer (KYC) verification, and specific reporting protocols. These requirements are evolving rapidly, so staying informed is crucial.

Tax treatment adds another layer of complexity. Since the IRS classifies cryptocurrency as property, you'll need to record the fair market value of crypto received at the time of transaction and report it as gross income. If you hold cryptocurrency rather than converting it immediately, you'll also need to track subsequent value changes and report capital gains or losses when you eventually convert to traditional currency.

There's also a technical learning curve, though payment processors have significantly simplified the process. Still, you and your staff will need some basic understanding of how cryptocurrency works to handle customer questions and troubleshoot issues.

The Reuters report on El Salvador's Bitcoin adoption highlights these challenges on a national scale. Despite government backing and significant resources, implementation problems and financial losses demonstrate that even well-funded initiatives require careful planning and risk management.

With the right approach and tools, however, these challenges are manageable. In the next section, we'll explore how SuperDupr's solutions help businesses steer these waters successfully.

How to Accept Crypto Payments with SuperDupr: Product Overview

At SuperDupr, we've built something special – a payment solution that makes accepting cryptocurrency payments feel as natural as taking a credit card, but with all the added benefits crypto brings to your business.

Our platform doesn't just process payments – it solves the four big challenges merchants face when considering crypto: integration headaches, currency confusion, price volatility, and compliance worries. Whether you're running a cozy Shopify store or managing a complex enterprise system, we've made the process surprisingly straightforward.

What makes our customers smile? The ability to accept Bitcoin, Ethereum, and dozens of other cryptocurrencies while automatically converting to dollars, euros, or pounds to avoid market swings. Plus, our built-in compliance tools handle the regulatory side so you can focus on your business.

Here's how we stack up against traditional payment methods:

Payment Method Average Fee Settlement Time Chargeback Risk Global Accessibility Credit Cards 2.9% + $0.30 2-3 business days High Limited by region ACH/Bank Transfer 0.8% or $5 cap 3-5 business days Low US only PayPal 3.49% + $0.49 Instant (for fee) Medium 200+ countries SuperDupr Crypto 0.8% Same day None 176+ countries

One of our e-commerce clients put it best: "We were on the fence about crypto because of the volatility thing. But with SuperDupr handling the instant conversion, that worry disappeared. Now we're seeing 12% more international orders and saving a small fortune on processing fees."

SuperDupr Crypto Payment Solutions

Getting started with crypto shouldn't feel like learning a new language. That's why we've made our onboarding process refreshingly simple – typically taking minutes instead of the weeks you might expect.

The sign-up process feels more like setting up a social media account than a payment processor. Enter your business details, verify your account, and we'll guide you through connecting to your existing systems. No technical degree required.

Where we really shine is making compliance painless. Behind the scenes, our system handles the complex verification requirements, screens against global watchlists, and keeps your business on the right side of regulations – all automatically updating as laws evolve.

Your checkout experience should reflect your brand, not ours. That's why we've made everything customizable – from the colors and logo on the payment page to the way prices display. Your customers get a seamless experience that feels like an extension of your store, with clear pricing and exchange information that builds trust.

A restaurant owner using our system recently told us: "The checkout looks exactly like our brand, and customers love seeing the transparent pricing. The compliance part just happens in the background – which was honestly my biggest worry before we started."

Auto-Conversion & Settlement

Price swings shouldn't keep you up at night. Our auto-conversion features ensure you get the benefits of crypto without the rollercoaster ride.

Many merchants love our stablecoin support – these are cryptocurrencies like USDC, USDT, and DAI that maintain a steady value tied to the US dollar. They offer all the speed and security benefits of crypto without the price fluctuations of Bitcoin or Ethereum.

For businesses that prefer traditional currency, our instant fiat conversion is the perfect solution. You can set rules to automatically convert incoming crypto payments to your preferred currency – dollars, euros, pounds, or others – and have the funds deposited directly to your bank account. You choose how often you want settlements – daily, weekly, or whenever you need them.

We also understand that flexibility matters. Some businesses want to convert everything to dollars immediately, while others might want to keep a small percentage in Bitcoin as an investment. Our dashboard lets you set these preferences with a few clicks and change them anytime as your strategy evolves.

As one retail client explained: "Being able to automatically convert most payments to USD while keeping a small Bitcoin reserve has been perfect for us. We get the stability we need for day-to-day operations while still maintaining some exposure to potential upside."

Plugins & API Integration

Tech integration shouldn't be a headache. That's why we've created multiple ways to connect SuperDupr to your business.

For most merchants, our no-code plugins are the simplest solution. We've built pre-made connections for all the popular platforms – WooCommerce, Shopify, Magento, OpenCart, Wix, Square, and many more. Installing these typically takes less than 30 minutes and requires zero coding knowledge. Just a few clicks and you're ready to accept your first crypto payment.

For businesses with unique needs, our developer-friendly API provides ultimate flexibility. We've created clean, well-documented interfaces with SDKs for all major programming languages, webhook support for real-time notifications, and customizable transaction flows to match your exact requirements.

Before going live, you can test everything in our sandbox environment – a fully functional replica of our payment system where you can run simulated transactions without any fees. This gives your team the confidence that everything works perfectly before your first real customer arrives.

A technical lead at an e-commerce company recently shared: "I've worked with dozens of payment APIs, and SuperDupr's documentation and support team are genuinely impressive. We built a custom checkout flow that fits our exact user journey, and their team was there every step of the way."

For more technical details on integration options, our Crypto Payment Integration guide provides comprehensive documentation.

Advanced Features

Beyond basic payments, we've built specialized tools for businesses with unique needs.

Nonprofits and cause-based organizations love our donation support features. These include customizable donation widgets, recurring donation options, automatic tax receipt generation, and donor management tools that make fundraising in crypto surprisingly effective.

Subscription businesses benefit from our subscription management system. This handles recurring billing at whatever intervals you need, provides a comprehensive dashboard for managing subscribers, and includes a customer self-service portal where your members can manage their own subscriptions.

For businesses where transaction privacy matters, we offer improved privacy options that reduce data collection while still maintaining regulatory compliance. These features respect customer privacy while keeping your business aligned with global regulations.

Technical organizations often appreciate our self-hosting options. These give you complete control over your payment infrastructure, allowing for deeper customization and direct blockchain integration for specialized applications.

A subscription box service recently told us: "The recurring billing feature has completely transformed our business model. We've seen customer retention improve by 22% since implementing SuperDupr's crypto subscription tools – it's been a game-changer."

Integration, Compliance & Volatility Hacks for Merchants

Successfully adding crypto payments to your business isn't as complex as it might seem. Let's walk through the practical steps to handle integration, stay compliant, and manage those price swings that make some merchants nervous about crypto.

Technical Integration Strategies

Getting set up to accept cryptocurrency payments comes down to choosing the right approach for your business size and technical comfort level.

If you're running a small shop on Shopify or WooCommerce, our no-code plugins make it almost as simple as installing any other app. You'll download the plugin, enter your API keys, and adjust a few settings to match your brand. Most merchants complete this process in under 30 minutes.

For larger businesses with custom checkout flows, our API integration gives you complete control. While this requires some developer time, it allows you to create exactly the payment experience you want for your customers.

Not ready for either option? Our hosted checkout solution is perfect for getting started quickly. Simply add a "Pay with Crypto" button that directs customers to our secure, branded payment page. No coding needed!

Before going live, take time to run through the entire payment process in our sandbox environment. Process a test transaction, check how confirmations display, try the refund workflow, and make sure everything looks good on mobile devices.

Don't forget about your team! Create simple guides for your staff on handling crypto payments and train your customer service team on answering basic questions. Having clear procedures for refunds will save headaches down the road.

Compliance Best Practices

The regulatory landscape for cryptocurrency varies widely around the world, but following these core practices will keep you on solid ground in most regions.

Know Your Customer (KYC) requirements are often the first compliance hurdle. SuperDupr's built-in verification tools make this seamless, automatically applying the appropriate level of verification based on transaction size. This means small purchases can proceed quickly while larger transactions receive proper scrutiny.

For Anti-Money Laundering (AML) compliance, we've built in transaction monitoring that flags unusual patterns. You'll want to establish internal procedures for reviewing these alerts and maintaining records of your due diligence.

The tax piece is where many merchants get tripped up. In most countries, you'll need to record the fiat value of each crypto payment at the exact time it occurs. Our reporting tools make this automatic, generating the documentation you'll need for tax season. Many of our merchants connect these reports directly to QuickBooks or other accounting software.

"The compliance tools alone are worth the switch," one online retailer told us. "What used to be a manual headache is now completely automated."

Volatility Management Tactics

Crypto price swings don't have to impact your business when you have the right strategies in place.

The simplest approach is using our instant conversion settings. When enabled, we automatically convert incoming cryptocurrency to your preferred fiat currency (USD, EUR, etc.) the moment payment is received. The funds then deposit directly to your bank account on your preferred schedule—daily, weekly, or monthly.

Many of our merchants prefer to prioritize stablecoins like USDC and USDT. These digital currencies maintain a steady value pegged to the US dollar, giving you the benefits of crypto payments without the volatility. Some businesses even offer small discounts for stablecoin payments to encourage their use.

The most sophisticated merchants often use a hybrid approach. As one e-commerce store owner explained: "We convert 90% of incoming crypto to USD immediately for our operating expenses, but keep 10% in Bitcoin as a long-term investment. This gives us stability while still letting us benefit from Bitcoin's growth potential."

Your strategy can evolve as you get more comfortable with crypto payments. Many businesses start with 100% conversion to fiat and gradually experiment with holding small amounts in digital assets.

For step-by-step implementation guidance, check out our comprehensive guide on How to Integrate Crypto Payments on Website.

Frequently Asked Questions about Accept Cryptocurrency Payments

Is it legal to accept crypto in my region?

The crypto regulation landscape changes faster than most of us can keep up with! While many countries accept cryptocurrency payments, others have strict limitations or outright bans.

In generally crypto-friendly regions like the United States, Canada, the European Union, United Kingdom, Australia, Singapore, and Japan, accepting crypto payments is legal—though with proper reporting requirements.

On the flip side, countries like China, Bolivia, Egypt, Morocco, and Nepal have significant restrictions or have banned cryptocurrency transactions entirely.

Even in crypto-friendly places, you'll need to steer several regulatory considerations:

Local tax regulations that determine how crypto income is reported

Money transmission laws that might apply to certain crypto activities

KYC/AML (Know Your Customer/Anti-Money Laundering) requirements for larger transactions

Before you dive in, we strongly recommend chatting with a legal professional who understands cryptocurrency regulations in your specific area. The good news? SuperDupr's compliance tools are specifically designed to help you meet requirements in all the regions we support.

How are refunds handled without chargebacks?

One of the biggest differences between traditional and crypto payments is the absence of the dreaded chargeback. While this protects merchants from fraud, it does change how refunds work.

When you accept cryptocurrency payments, refunds become a more intentional process. You'll need to initiate a brand new transaction to send funds back to your customer, rather than simply reversing the original charge.

This means keeping detailed records of original purchases, customer refund requests, and the separate refund transactions you process. With SuperDupr, handling refunds is straightforward—just log into your merchant dashboard, find the original transaction, click "Issue Refund," choose a full or partial amount, and confirm.

You have several options for how to handle refunds:

Send back the same cryptocurrency used in the original purchase

Refund in traditional currency through alternative methods

Offer store credit or exchanges instead

One of our e-commerce clients shared an interesting observation: "We've noticed fewer refund requests with crypto payments. When customers understand the refund process is more deliberate, they tend to make more thoughtful purchasing decisions in the first place."

Clear communication about your refund policy is especially important since many customers may be unfamiliar with how crypto refunds work.

What taxes do I owe when I receive crypto?

Tax time can make anyone's head spin, and cryptocurrency adds another layer of complexity. While I can't offer tax advice (please consult a professional for your specific situation!), I can share the general framework most businesses need to understand.

When you accept cryptocurrency payments, the IRS and many other tax authorities treat those payments as gross income. The taxable amount is the fair market value of the crypto in your local currency at the moment you receive it. This income typically faces the same taxes as any other business revenue.

If you hold onto that cryptocurrency instead of immediately converting it, things get more interesting. Any change in value creates potential capital gains or losses. When you eventually convert to traditional currency or another cryptocurrency, you'll trigger a taxable event. The difference between the value when you received it and when you converted it determines your gain or loss.

Record-keeping becomes absolutely crucial:

When each transaction occurred (date and time)

What the fair market value was when you received it

Your cost basis for each cryptocurrency unit

When and at what value you converted or sold

Any associated transaction fees

SuperDupr makes this much easier with automated fair market value recording, exportable transaction reports, integration with popular tax software, cost basis tracking, and year-end summaries.

As one relieved business owner told us, "The tax reporting features alone made SuperDupr worth it for us. What would have been days of accounting headaches is now automated, and we're confident our crypto tax reporting is accurate."

Tax regulations vary widely by location, so working with a tax professional familiar with cryptocurrency in your jurisdiction is always the safest approach.

Conclusion

The future of payments is digital, and cryptocurrency represents a significant evolution in how businesses can receive funds from customers around the world. By choosing to accept cryptocurrency payments, you're not just adopting a new technology—you're positioning your business for the future of commerce.

As we've explored throughout this guide, the benefits are substantial: lower fees, elimination of chargebacks, global accessibility, and access to a growing market of crypto-native customers. While challenges exist—from volatility to compliance—modern tools like SuperDupr's payment platform make these manageable even for businesses without technical expertise.

To successfully implement cryptocurrency payments:

Start with a pilot program - Perhaps begin with a limited product line or as an optional payment method

Choose the right integration approach for your technical resources and business needs

Implement proper volatility management through instant conversion or stablecoin preferences

Ensure compliance with relevant regulations in your jurisdiction

Train your staff on the basics of cryptocurrency transactions and your specific implementation

As one business owner who successfully implemented crypto payments shared: "We started small, accepting Bitcoin for just our premium products. The positive customer response and operational benefits led us to expand to our full product line and additional cryptocurrencies within three months."

At SuperDupr, we're committed to making cryptocurrency acceptance simple, secure, and beneficial for your business. Our team of experts provides end-to-end support, from initial strategy through implementation and ongoing optimization.

Ready to explore how cryptocurrency payments can benefit your business? Learn more about our Cryptocurrency Merchant Services or contact us today for a personalized consultation.

The future of payments is here—and with SuperDupr as your partner, accepting cryptocurrency doesn't have to be complicated.